Article

Unveiling the Reality of Retail Crime in the UK: Trends, Challenges, and Solutions

by Sarah French, Associate Retail Analyst

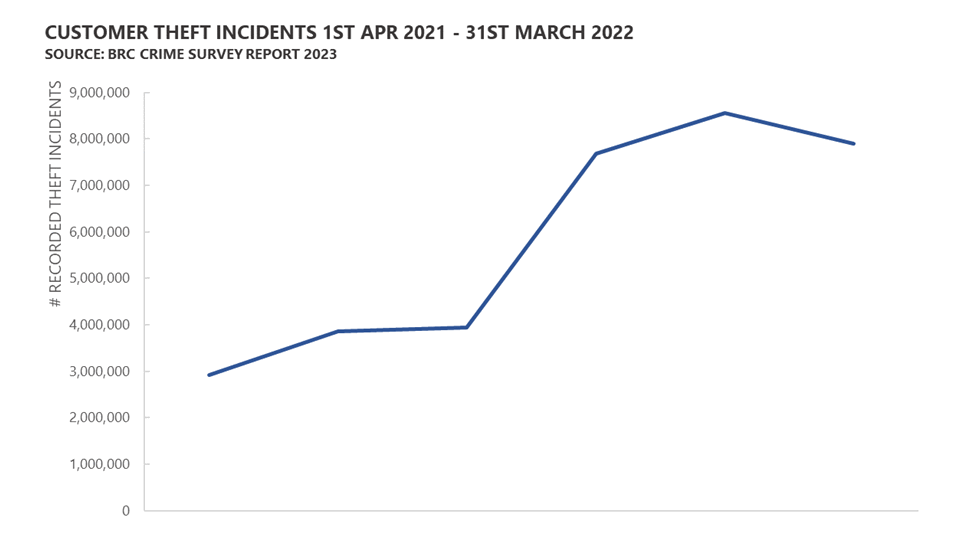

Amid a cost-of-living crisis, high inflation and soaring food prices, incidents of shoplifting and retail crime have exploded. According to the British Retail Consortium (BRC), retail theft has grown to eight million incidents a year, with £953 million being lost to customer theft in the latest year alone. This isn’t just a UK phenomenon; in the US National Retail Federation (NRF) revealed that organised retail crime (ORC) reached $94.5bn in 2021, with ORC being the primary driver of retail shrink.

Real-world data with real-world ROI

If you look at C-suite role responsibilities in major U.S. retailers, a pattern emerges: The role of the retail CMO has expanded to be centered around the customer experience. So, how are they working to advance the customer experience? Following the money can provide some insight. According to a 2022 survey by global research firm Gartner, CMOs' top three areas of investment today are:

- Campaign creation and management (10.1%)

- Brand strategy (9.7%)

- Marketing operations (9.6%)

And considering that same report noted that the average total marketing budget is around 10% of an organization's total revenue, these areas represent serious financial investment. But how are they evaluating the success or failure of these investments?

Sure, they can know if revenue is up or down, how a given product performed, and how their digital metrics tracked versus benchmarks. But can they know if their campaigns and promotions captured shoppers' attention — and share of wallet — at the merchandise display level? Can they truly evaluate if their brand strategy is engaging their target shopper? Or if their merchandising and brand experience is on point? And, most importantly, can they actually know whether their strategic areas of investment are positively impacting their top priority, namely, the customer experience?

They can — if they leverage the right data. Here's how.

Build better personas

Let's say you spent months building shopper personas using personal information provided by shoppers when they enrolled in your loyalty program. Perhaps you've even enlisted the help of a pricey consulting firm or agency. The personas they can deliver — likely based on information from focus groups, surveys, or both — are thorough and precise.

All in all, it's a fine start, but it's only a start.

To truly understand their shoppers, retailers may want to consider incorporating in-store and beyond-the-store data that can be captured by Traffic Counting solutions, as well as solutions powered by Computer Vision. By evaluating the demographics of your shoppers, how frequently each segment visits, how long each segment shops, and the paths they take through the store, you can get a much more concrete idea of who your shoppers truly are and what they actually want.

But don't stop there: Consider gaining valuable insights through store guest behaviour analytics. Leading in-store multi-sensor data solutions can capture shoppers' engagement along their path to purchase. This data can reveal how your shoppers perceive your brand and view visits to your stores — are they visiting strictly to pick up routine essentials or are they stopping to browse promotional items and displays, or both, or some other pattern? As you can see, this data provides key information for successful big-picture marketing.

So, what are retailers doing to try and combat this?

Some supermarkets have taken to adding security tags to basic food items such as cheese and meat, whilst others have reduced the number of high-value products on the shelves. At some of its stores, M&S has limited the number of steaks on display, with the Co-op following suit for items such as jars of coffee. This has also been seen in the US, with Walgreens having renovated one of its Chicago stores and putting most of the products behind counters. There are now just two low-rise aisles with low-cost essentials, with the shelves being no taller than five feet so that staff can view customers shopping.

As self-checkouts become more prevalent, some shoplifters have become more daring. In response, several Sainsbury's and Morrisons branches have introduced receipt scanning before allowing customers to exit, which has received mixed reactions. PwC's retail strategy director, Kien Tan, expressed disapproval of this measure, stating that it "completely undermines the purpose of self-scan." However, Sainsbury's clarified that this technology is not new and is only being implemented in a limited number of stores.

Other retailers have gone to more extremes. Frasers Group has been criticised for employing live facial recognition cameras which “scan the face of every shopper and check them against a database of suspected shoplifters.” Almost 50 MPs and peers have written to Frasers Group to condemn its use, describing the technology as “invasive and discriminatory.” Speaking to the BBC however, Frasers has said that since installing the technology, the group had “seen a significant reduction in the number of criminal offences taking place in our stores”, adding that it informs shoppers when the technology is being utilised in a store.

Taking the opposite approach, Waitrose is employing “love-bombing” to deter shoplifters, aiming to tackle theft by having store staff be “extra attentive, causing thieves to think twice.” This follows the scheme being piloted in six-stores earlier this year; it has now been rolled out across all branches. Waitrose says this approach has been particularly effective at self-checkouts, where thieves would normally try to scan items as cheaper alternatives, or not scan them at all. Speaking to The Grocer, Waitrose’s head of security, Nicki Juniper, said, “We’ve long been known for our friendly service, but it turns out that the more attentive we are, the less likely people are to steal.”

Another tactic has been the use of private policing, which London businesses are “increasingly” turning to because they claim the Metropolitan police won’t attend shoplifting incidents, reports the BBC. Some areas of London are now using the ‘My Local Bobby’ scheme, which for a fee, offers a warden service. Johnny Dyson of The Junction BID, who introduced two wardens from the scheme back in November, said “it’s working brilliantly.” He said that while some of the shoplifters are “still the same people a year on” they are less prolific, with the wardens being a “very big visible deterrent.”

The relevant data for the right use case

In-store data can provide a glut of riches in terms of customer insights — but it can also lead to over-analysis and lack of clarity on which actions to take. After all, with so many activities to measure, how do you know you're analyzing the right metrics? And what are retailers supposed to benchmark these metrics against? Simply put, what's important, what's merely a nice-to-have data point, what's relevant, and what's noise?

There's no single answer that applies to every single retail sector and use case — and that's actually a good thing.

Consider two very different retailers whose customers have very different needs and priorities. Retailer A operates big-box technology stores that sell a variety of gadgets, ranging from inexpensive devices to computers and hardware costing in the thousands. Their customers often need knowledgeable guidance from well-informed associates before making a large purchase.

Retailer A will want to measure customer engagement — how many customers spent time talking with associates and how many of those customers then made a purchase — along with their shopper-to-associate ratio (STAR) to ensure they can deliver exceptional customer service.

Retailer B, on the other hand, is a food and beverage outlet that specializes in convenience and low-cost items. Their customers want to find what they're looking for quickly, check out seamlessly, and get on with their days.

This retailer will want to focus on metrics around speed and convenience. How long do customers take to locate the items that they're looking for? How long do they wait in line at checkout? How often do they abandon areas or displays they initially showed interest in? How frequently do shoppers return — a good proxy metric for determining customer satisfaction with your product mix and the convenience of your layout?

While these retailers may have largely different priorities, they'll both likely want to capture demography to see who they're reaching and if they're truly their target shoppers. They'll also want to examine path analytics to optimize store layouts, along with dwell times in front of displays and promotions. They'll probably also discover target persona insights with on-shelf visibility powered by Computer Vision to see who engages with which products.

In short, what matters is that retailers focus on the metrics that matter to them, rather than trying to measure every single shopper activity available. That's the difference between gaining game-changing shopper insights and experiencing paralysis by analysis.

Takeaways

There's never been a better time to be a retailer. There are more ways to reach and engage customers than ever, and there have never been more opportunities to capture the kind of customer insights that can empower retailers to make data-driven decisions that deliver better shopper experiences and improve profitability.

The key is to focus on the metrics that align with your stores' mission and your shoppers' needs and using those insights to develop better personas, more effective merchandising and layouts, and gain a better understanding of your brand's perception. That's something retail marketing leaders have dreamed about — and something savvy CMOs can realize today.

To learn more about the metrics you should focus on in stores and beyond, download our white paper, Creating Experiential Retail Along the Shopper Journey. Or, if you're ready to talk, reach out today.

Explore Related Topics