Article

Unveiling the Reality of Retail Crime in the UK: Trends, Challenges, and Solutions

by Sarah French, Associate Retail Analyst

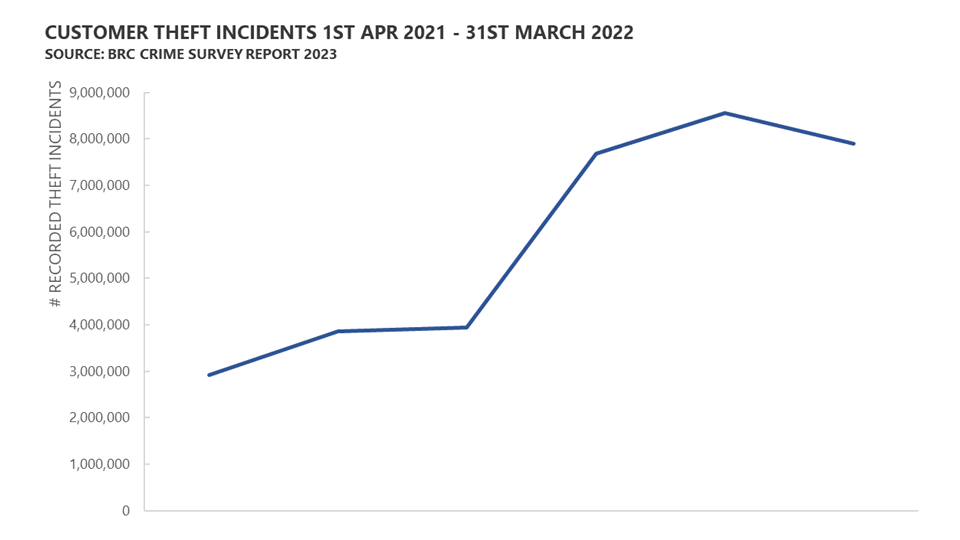

Amid a cost-of-living crisis, high inflation and soaring food prices, incidents of shoplifting and retail crime have exploded. According to the British Retail Consortium (BRC), retail theft has grown to eight million incidents a year, with £953 million being lost to customer theft in the latest year alone. This isn’t just a UK phenomenon; in the US National Retail Federation (NRF) revealed that organised retail crime (ORC) reached $94.5bn in 2021, with ORC being the primary driver of retail shrink.

Real-world data with real-world ROI

As we all well know, the pandemic forced an aggressive online strategy in APAC (and around the world), but signs show people are craving in-person experiences. So, it's not surprising that high on the list of CMO Australia's top ten customer experience predictions for 2023 is that businesses will get "serious about the total experience." So, what does that mean? According to Verint Vice President Marketing Asia-Pacific and Japan, Martyn Riddle, it means this:

“Brands must ensure they provide a fluid and frictionless experience across all channels in order to attract and maintain cross-generational customer loyalty. This will mean a step-change in various technologies including real-time analytics, social listening, AI and automation if they want to drive real-time customer journeys and offer genuine one-to-one personalisation – whether in-store, on the phone or via WhatsApp or chatbots.”

In terms of how CMOs plan to achieve this, we can follow the money. A 2022 survey by global research firm Gartner, found CMOs' top three areas of investment today are:

- Campaign creation and management (10.1%)

- Brand strategy (9.7%)

- Marketing operations (9.6%)

And considering that same report noted that the average total marketing budget is around 10% of an organisation's total revenue, these areas represent serious financial investment. But how are they evaluating the success or failure of these investments?

Sure, they can know if revenue is up or down, how a given product performed, and how their digital metrics tracked versus benchmarks. But can they know if their campaigns and promotions captured shoppers' attention — and share of wallet — at the merchandise display level? Can they truly evaluate if their brand strategy is engaging their target shopper? Or if their merchandising and brand experience is on point? And, most importantly, can they actually know whether their strategic areas of investment are positively impacting their top priority, namely, the customer experience?

They can — if they leverage the right data. Here's how.

Build better personas

Let's say you spent months building shopper personas using personal information provided by shoppers when they enrolled in your loyalty programme. Perhaps you've even enlisted the help of a pricey consulting firm or agency. The personas they can deliver — likely based on information from focus groups, surveys, or both — are thorough and precise.

All in all, it's a fine start, but it's only a start.

To truly understand their shoppers, retailers may want to consider incorporating in-store and beyond-the-store data that can be captured by Traffic Counting solutions, as well as solutions powered by Computer Vision. By evaluating the demographics of your shoppers, how frequently each segment visits, how long each segment shops, and the paths they take through the store, you can get a much more concrete idea of who your shoppers truly are and what they actually want.

But don't stop there: Consider gaining valuable insights through store guest behaviour analytics. Leading in-store multi-sensor data solutions can capture shoppers' engagement along their path to purchase. This data can reveal how your shoppers perceive your brand and view visits to your stores — are they visiting strictly to pick up routine essentials or are they stopping to browse promotional items and displays, or both, or some other pattern? As you can see, this data provides key information for successful big-picture marketing.

So, what are retailers doing to try and combat this?

Some supermarkets have taken to adding security tags to basic food items such as cheese and meat, whilst others have reduced the number of high-value products on the shelves. At some of its stores, M&S has limited the number of steaks on display, with the Co-op following suit for items such as jars of coffee. This has also been seen in the US, with Walgreens having renovated one of its Chicago stores and putting most of the products behind counters. There are now just two low-rise aisles with low-cost essentials, with the shelves being no taller than five feet so that staff can view customers shopping.

As self-checkouts become more prevalent, some shoplifters have become more daring. In response, several Sainsbury's and Morrisons branches have introduced receipt scanning before allowing customers to exit, which has received mixed reactions. PwC's retail strategy director, Kien Tan, expressed disapproval of this measure, stating that it "completely undermines the purpose of self-scan." However, Sainsbury's clarified that this technology is not new and is only being implemented in a limited number of stores.

Other retailers have gone to more extremes. Frasers Group has been criticised for employing live facial recognition cameras which “scan the face of every shopper and check them against a database of suspected shoplifters.” Almost 50 MPs and peers have written to Frasers Group to condemn its use, describing the technology as “invasive and discriminatory.” Speaking to the BBC however, Frasers has said that since installing the technology, the group had “seen a significant reduction in the number of criminal offences taking place in our stores”, adding that it informs shoppers when the technology is being utilised in a store.

Taking the opposite approach, Waitrose is employing “love-bombing” to deter shoplifters, aiming to tackle theft by having store staff be “extra attentive, causing thieves to think twice.” This follows the scheme being piloted in six-stores earlier this year; it has now been rolled out across all branches. Waitrose says this approach has been particularly effective at self-checkouts, where thieves would normally try to scan items as cheaper alternatives, or not scan them at all. Speaking to The Grocer, Waitrose’s head of security, Nicki Juniper, said, “We’ve long been known for our friendly service, but it turns out that the more attentive we are, the less likely people are to steal.”

Another tactic has been the use of private policing, which London businesses are “increasingly” turning to because they claim the Metropolitan police won’t attend shoplifting incidents, reports the BBC. Some areas of London are now using the ‘My Local Bobby’ scheme, which for a fee, offers a warden service. Johnny Dyson of The Junction BID, who introduced two wardens from the scheme back in November, said “it’s working brilliantly.” He said that while some of the shoplifters are “still the same people a year on” they are less prolific, with the wardens being a “very big visible deterrent.”

Retail crime is more than theft

Retailers are not only dealing with the challenge of shoplifting but also facing a significant increase in incidents of violence and abuse directed towards their workers. According to the BRC, these incidents have more than doubled since before the pandemic, where over 10% of workers have suffered some form of harassment. Research from the Institute of Customer Service suggests that the rise in hostility towards retail workers can be attributed, at least in part, to price increases. Approximately 33% of staff surveyed believe that higher levels of anxiety among shoppers are triggering this behaviour.

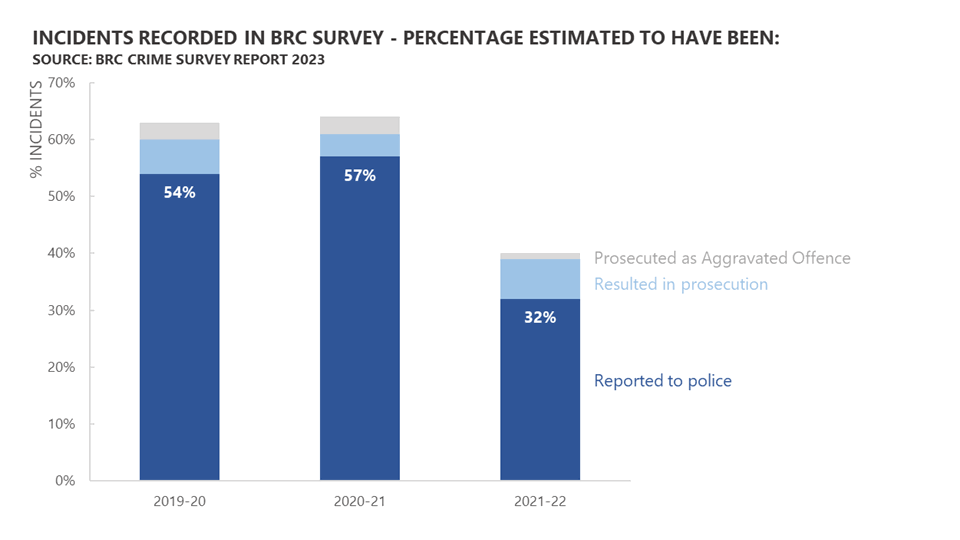

Speaking about the BRC’s Crime Survey, Sussex Police and Crime commissioner, Katy Bourne, emphasised the need for businesses to report incidents and provide evidence. She added, “It’s clear that we will only drive crime down by bridging some of the gaps that still remain in reporting processes, police response, criminal justice sanctions and a partnership approach to prevention.”

What else can retailers do to protect staff and inventory?

Obviously not all retailers can afford to employ private policing, nor they can they afford (or want to) employ the use of facial recognition. So, what can retailers actually do?

As the retail landscape and associated crime continue to evolve, it is crucial for loss prevention strategies to adapt accordingly. Retail has become increasingly seamless, with the introduction of self-checkouts and scan-as-you-shop options making the purchasing process more convenient. However, this convenience has also made it easier for individuals to engage in theft. Consequently, retailers find themselves engaged in a constant game of cat and mouse with thieves in order to safeguard their merchandise. If stores put higher value items out on display, they risk being stolen, but if they protect them and put them behind the counter, then retailers risk losing sales. Retailers need to be able to navigate this balance.

Retailers’ utilisation of data is key. If retailers are limiting the amount of stock on display, then they need to be swiftly alerted when these items need to be restocked to avoid losing sales. Using inventory data can also help retailers determine which products are being targeted by thieves, and when these events are taking place. Data can also be used to optimise labour allocation, and determine the best times of day for different tasks to be carried out.

Going one step further, using video analytics can further empower retailers in their fight against shoplifters. Video analytics can alert retailers when shoplifting events are taking place, if customers are behaving aggressively, and if people are attempting to conceal products.

Speaking with Sensormatic, Corin Dennison of Adidas added, “While shrink is never going to go away, the utilisation and combination of different data sets can be used to help minimise losses and prevent some future shrink events from even happening. These kind of data projects require guided analysis and insightful application to be successful, but have the potential to saves millions in lost revenue.”

Discover more about Sensormatic's Shrink Visibility and Video Intelligence solutions, or get in touch with the team to start the discussion.

Explore Related Topics