Article

Christmas 2022 – what impact will the cost of living crisis have on footfall?

With inflation soaring, energy bills increasing, the value of the pound dropping, and retail sales declining, the UK retail industry is going to face significant pressures during the 2022 festive season. Throw in the potential footfall disruption caused by the Qatar 2022 World Cup viewership, and this year’s Christmas period looks more unpredictable than ever.

What does 2022 look like so far?

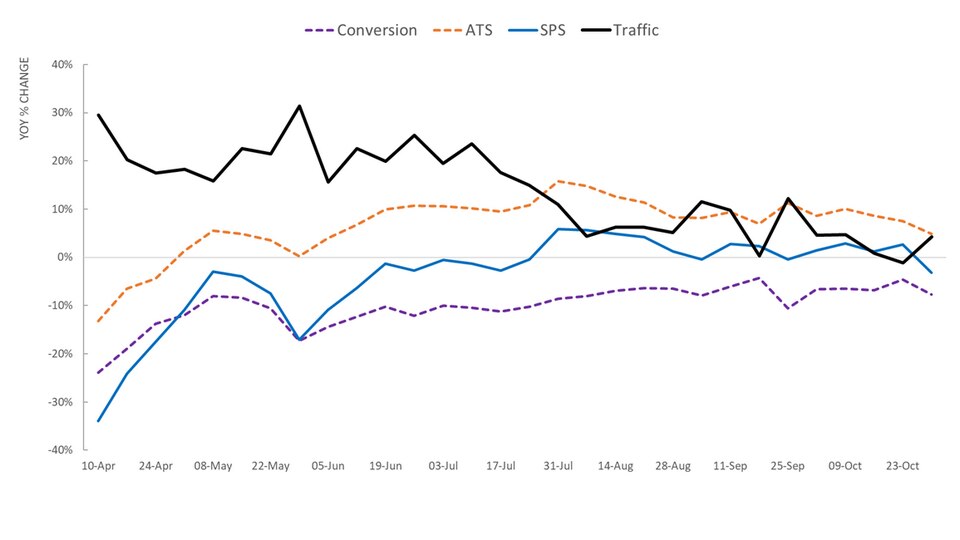

Year-over-year traffic was higher at the beginning of 2022 due to prior year visitor numbers being at a lower level as we emerged from the third national lockdown. Over the past few weeks, traffic has gradually fallen to a more “normal” level. Whilst conversion has remained in negative figures all year so far, it is climbing, and SPS (Sales Per Shopper) has improved despite traffic levelling off. This suggests that while fewer people may be shopping, those who are have been spending more. This could be due to people trying to consolidate their shopping trips – which is something retailers need to be aware of as we look ahead to the Christmas shopping period. There are several factors which could have a significant impact on footfall and sales:

Soaring prices and falling sales

The topic on everyone’s minds at the moment is the cost-of-living crisis. With energy bills rising even further - although not to the same extent as originally anticipated - and inflation driving prices ever-higher, four in ten people say they are worried about being able to afford Christmas this year. Add in the value of the pound hitting record lows against the dollar, UK consumers are set to see goods and services become even more expensive. With all this in mind, it comes as no surprise that retail sales fell by 1.6% in August. What does this mean for the remainder of the year?

Spreading the cost

In contrast to Christmas 2020, which saw families spend more on Christmas to make up for a tough year following the pandemic, Christmas 2022 is looking to go in the opposite direction, with some families simply unable to afford to spend much this year. While retailers no longer need worry about implementing social distancing and Covid safety measures, the challenge will be getting customers in the door and spending in the first place.

This year, consumers are largely expected to spread the cost of Christmas, with people starting their shopping earlier and hunting for bargains. With this in mind, some retailers are getting ahead and launching their Christmas ranges early, with Homebase opening its online Christmas store ‘earlier than ever this year’ on 3rd September. In addition to this, Amazon for the first time launched a second Prime Day event from 11-12 October, called the ‘Prime Early Access Sale,’ which was available in a number of countries worldwide.

Industrial action

Another issue for retailers to factor in is planned strike action by both railway and Royal Mail workers. Royal Mail workers have planned several days of strike action during the build-up to Christmas, which will also cover Black Friday weekend. Retailers and consumers should expect disruptions to deliveries. Industrial action is also being planned by rail unions over several days in November, meaning that staff may not be able to get into work, and customers won’t be able to visit stores, which will impact both footfall and customer service levels.

Footfall’s coming home?

A more unpredictable factor is the Qatar 2022 FIFA World Cup. The tournament is happening during winter for the first time ever and matches will take place over the peak shopping period. The final is being held just a week before Christmas – at 3 o’clock in the afternoon. Will Higham from Next Big Thing predicts that the World Cup will “probably cannibalise some of the Black Friday and Christmas spend,” although James Hardiman from the British Retail Consortium (BRC) points out that much of it depends on how far England and Wales make it in the tournament.

The World Cup Quarter Finals take place on the 9th and 10th of December (two matches at 7pm and two matches at 3pm), and the third-place play-offs take place on the 17th of December at 3pm. According to our own analysis and predictions, the 10th and 17th of December will be the fourth and third busiest festive shopping days respectively, so if England or Wales end up playing in any of these matches, there could be significant impact on footfall. The timing of the matches will also be important, with evening matches being less likely to have an impact compared to daytime ones. Looking back to the 2018 World Cup, when there was an England match during the day, there was a significant impact on footfall. England vs Panama on Sunday 24th June at 1pm saw year-on-year footfall drop by -18%, and England vs Sweden on Saturday 7th July at 3pm saw footfall drop by -13%. Therefore, retailers may need to prepare for quieter periods during match time.

What are consumers telling us?

Many of the concerns mentioned above were echoed in Sensormatic’s September consumer sentiment survey. 31% of respondents said they had already started their Christmas shopping, with just 10% planning on waiting until December. 45% of respondents who said they planned on starting shopping earlier this year added that one of their key motivations for doing so was to avoid inflation-related price increases.

A whopping 62% of respondents to the survey cited finances and budgeting as a factor that influenced when they started their Christmas shopping, with 74% saying that price was important to them when shopping in-store this year. 32% also said that their personal financial situation would have a ‘big impact’ on their Christmas shopping budget, and they were planning on spending ‘significantly less’ when compared to 2021. When asked if they would be more cautious with discretionary spending over Christmas, 71% of respondents said they agreed or strongly agreed, with 73% saying they would spend more time on deal hunting. Over 50% said they would make fewer shopping trips to save on fuel, and 65% said they would set strict spending limits on gifts they were buying for others.

Stock availability was also a key factor, with 17% of people who said they had started shopping earlier citing concerns over shipping delays as a key motivation for doing so. 23% also raised concerns about supply chain disruption.

So, what can retailers do?

Balance delivery and return fees

While many people turn to online shopping to find better deals, consumers can find high delivery fees off-putting. A report by Digital River and Opinium found that whilst 30% of people surveyed said they shopped online due to items being cheaper, 48% said reduced delivery fees would be a way for retailers to help with surging costs. In addition to this, in our own consumer survey, 67% of respondents said they would choose to shop more with online retailers who offer free delivery.

However, with online shopping comes online returns, with “serial refunders” putting increased pressure on supply chains. Some retailers such as Zara and Boohoo have starting charging for online returns in a bid to cut down on over-ordering. According to a report by UserTesting however, 60% of consumers would consider shopping elsewhere if they were charged to return online orders, especially during a cost-of-living crisis. Retailers should carefully consider their stance on delivery and return fees during this peak period. For example, John Lewis has scrapped its minimum spend threshold for click-and-collect orders until October 19th, so that customers can make smaller orders ahead of Christmas to spread the cost.

Be ready for earlier shoppers and ensure enough inventory is available

As mentioned above, it is widely expected that people will start their Christmas shopping earlier this year. John Lewis has already seen this happening, with sales of Christmas trees up 37% already in comparison with the same period in 2021.

Retailers therefore need to ensure that they have enough inventory available. In our consumer sentiment survey, 46% of respondents said one of the reasons they would use click and collect is to avoid a wasted shopping trip due to items being out of stock in-store, while 44% said it gave them peace of mind as they knew their item would be available. In addition to this, 45% of people said one of their main reasons for shopping in-store was to see/touch products in person before buying, with 42% saying that confidence in stock availability would make them more likely to shop in-store. This highlights a very clear need for customers to have the ability to check stock levels online before making a visit – which Insider Intelligence says is ‘particularly valuable’ and is something launched earlier this year by Primark.

Keep customers happy!

Aside from this, one of the key things retailers can do is to ensure they are offering a seamless shopping experience. With many people planning to shop earlier than ever before, retailers should ensure they have enough staff available to assist customers. With there being an “unprecedented” change in consumer behaviour as inflation bites, many consumers are now switching brands in order to get better value for money, so retailers need to be conscious of this and offer great customer service to encourage customer loyalty.

Explore related topics