Article

Is it time for retail footfall to make a comeback?

Ah, the good old days of 2019. While only four years ago, the UK – and the rest of the world - felt like a very different place. There were only two UK Prime Ministers that year, Brexit was not yet finalised, Russia hadn’t launched its full-scale invasion of Ukraine, and of course, we had no idea that a once-in-a-lifetime global pandemic was on the horizon.

Four years, four Prime Ministers, and two Monarchs later, things have changed drastically. In addition to the above, inflation has jumped from just 2% in 2019 to a peak of 11.1% in October 2022, with “cost of living crisis” replacing “pandemic” as the phrase on everyone’s lips. Energy bills have climbed and climbed as the war in Ukraine has driven up fuel prices, and strike action has swept the country as workers across the NHS, transport network, education sector and civil service demand their wages keep pace with inflation. Following on from the pandemic, more of us are working from home, and numerous retailers, including Debenhams and Arcadia, have disappeared from our high streets altogether. With inflation predicted to add nearly £800 onto a typical annual shopping bill, consumers are certainly feeling the squeeze.

Bearing all of this in mind, and given how different 2022/2023 is compared to 2019, why are we still measuring retail and footfall performance against the pre-covid period? The “new normal” is a phrase that has been bandied about since 2020, but we still seem very keen to compare today’s “new normal” to 2019’s “old normal”. Whilst it is still beneficial to see if retail is on its way to recovering to pre-covid levels, is it not time that we moved on and started to look back to the previous year once again for comparison purposes?

Firstly, how does footfall look?

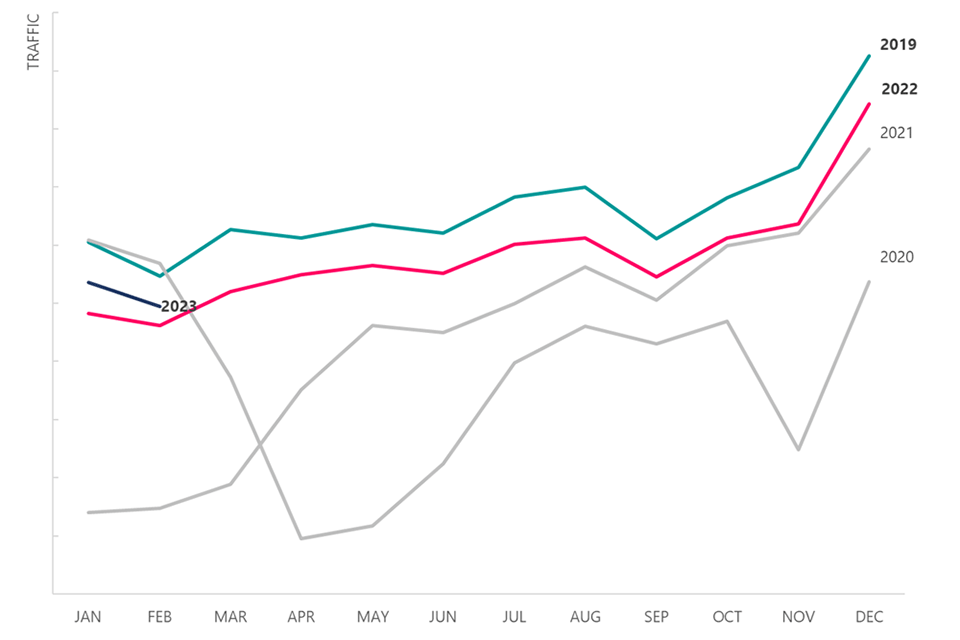

While of course 2020 and 2021’s traffic was anomalous due to the lockdown periods, 2022’s traffic trends follow that of 2019’s very closely, albeit overall footfall is still lower. 2022 was the first year in three years that no lockdowns were in place, with all remaining COVID-19 restrictions being lifted by March. Looking at 2023 so far, January retail traffic was up 12.5% against 2022, but down -6.5% against 2019. It is worth highlighting that the Omicron variant was still a concern during winter 21/22 which may have impacted footfall somewhat.

Cost of Living

Since 2021, the UK has been facing a cost-of-living crisis, with prices for many essential goods soaring. Household energy bills increased by 54% in April 2022 and another 27% in October, forcing some to have to choose between eating and heating. The Office for National Statistics (ONS) reports that food and drink prices have risen at their fastest rate since 1977, with food and non-alcoholic drinks inflation rising to 16.5% in November 2022.

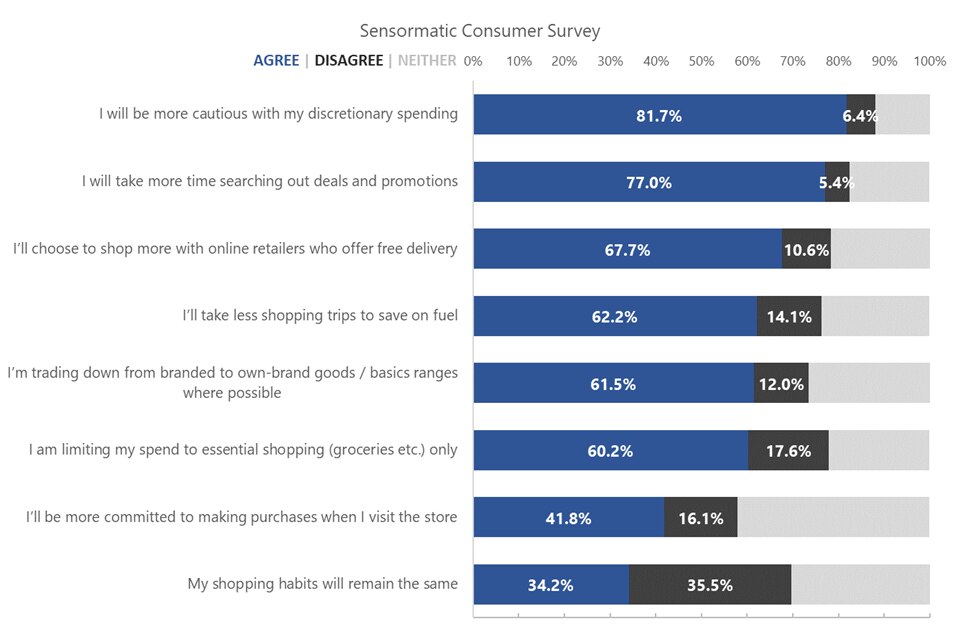

With this in mind, Sensormatic’s December 2022 consumer survey asked respondents about how they planned to shop in 2023. The good news for retailers is that 71% of respondents say that stores will be one of their main shopping channels in 2023, with 27% saying they will use Click & Collect. However, 60% said they will be limiting their spending to essential shopping (such as groceries) only, and 82% said they will be more cautious with their discretionary spending. And with fuel prices still high, 62% say they’ll make fewer shopping trips to save on fuel. Price is at the forefront of shoppers’ minds, with 83% saying price is the most important thing for them when shopping in-store, and only 34% saying that their shopping habits will stay the same given the current economic situation. So, while people may still be willing to visit stores, trips will be less frequent, and consumers will be more purposeful in their shopping.

Unexpectedly, retail sales volumes grew by 0.5% in January 2023 (when compared to December), according to data from ONS, following a fall in sales in the previous month. However, Lisa Hooker from PwC said that it was “hard to see” how this momentum would be maintained once seasonal discounts end, and inflation bites. When compared to January 2021, sales were down 5.1%.

In relation to the cost of living, strike action has been taking place across a number of industries in the UK, as workers demand better pay in-line with inflation. Drapers reported London-based retailers lost sales because people couldn't travel to stores and staff couldn't reach work during transport strikes. The ONS highlighted in December that 13% of businesses reported “some kind of impact” from industrial action, with small businesses, and the retail and construction sectors being worst hit.

The B Word

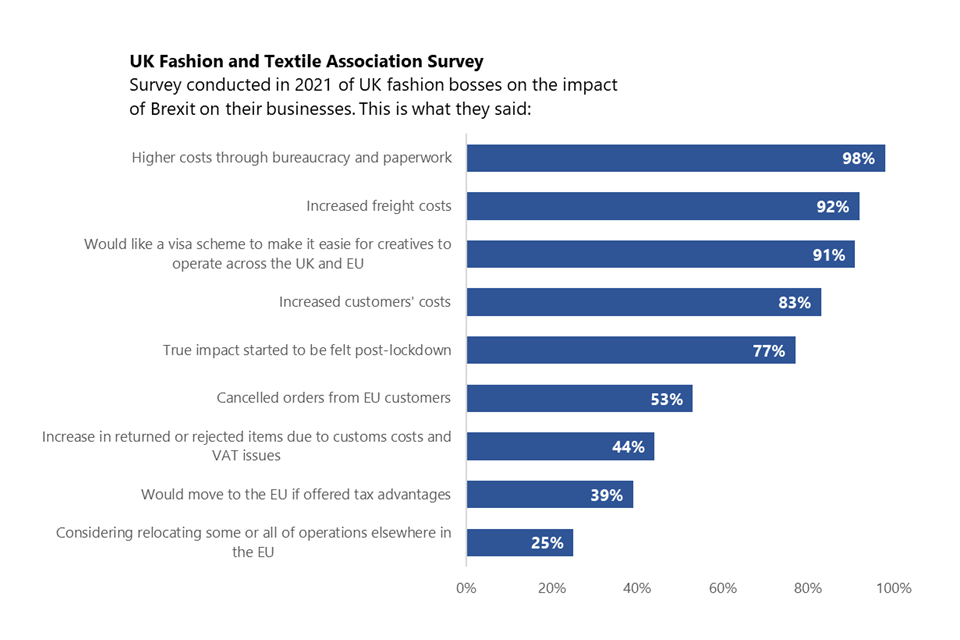

Although Brexit has been somewhat overshadowed by the COVID-19 pandemic and then the war in Ukraine, its effects are being felt on retail. A survey by Guardian Money found that retailers such as Zara and Decathlon are charging British shoppers up to 50% more than in Spain and France, with the blame being put on Brexit for making it more expensive to import stock. The British Retail Consortium adds that ‘the most difficult bit is yet to come’, with all imports being subject to full checks by early 2024. The BRC says that although the government is working on a streamlined system, ‘delays and costs will be inevitable.’

Brexit is also impacting the luxury market. According to the Centre for Economics and Business Research, there has been a 7.3% drop in international visitors to UK luxury brands, resulting in a £1.8bn loss. Following Brexit, the VAT rebate (which allows international visitors to claim back the UK’s 20% VAT on luxury purchases made in the UK) ended. In addition to this, UK brands being sold in the EU are subject to tariffs and quotas for selling there, meaning that foreign shoppers are more likely to buy from EU brands in the EU. This has resulted in Mulberry closing its Bond Street store – which opened in 1995 - with a spokesperson saying “the lack of VAT-free shopping in the UK has been particularly felt on Bond Street, which has always been an iconic shopping destination for tourists. The decline in visitors has impacted footfall and sales.” Harrods boss Michael Ward echoed this, saying that London is “trailing behind” Paris and Milan in luxury trade, and that Harrods has to “work much harder” to source exclusive designer goods that cannot be found in other European capitals, in a bid to encourage shoppers to come to the UK.

The impact of Remote Working

According to Centre for Cities, before COVID-19 forced many of us to work from home, the office-based workforce was “the key to the health of the high street”, with high performing high streets being fuelled by demand for local services by local workers. In 2022, between 25-40% of people were reported to be working from home, indicating that the office-based workforce has drastically declined as a target customer. A survey from Advanced Workplace Associates (AWA) found that Fridays are the UK’s most popular remote working day, with only 13% of employees going into the office. This was echoed by property firm Landsec, who said Fridays were almost “as quiet as the weekends” in the City of London, with the company’s Mark Allan adding “we certainly believe there are going to be fewer people in offices for the longer term and we are planning accordingly.” CBRE Investment Management said that empty office space in London has “more than doubled” in the last three years, with CBRE’s David Inskip highlighting that companies are going to have to do more than provide “just a desk and a computer” if they want to lure employees back to the office.

Centre for Cities adds that getting workers back to the office is a “big challenge for the high street” with nearly 70% of the gap between post and pre-covid spending levels being due to missing weekday spend. While some companies such as Frasers Group have told staff they can no longer work remotely, the Chartered Institute of Personnel and Development (CIPD) said two fifths of firms were planning to invest more in hybrid working, although added that “there’s no one-size-fits-all approach.”

Where does this leave us?

The world has changed significantly since 2019, and with that, so have consumers’ spending habits, patterns, and budgets. The cost-of-living crisis isn’t conducive to people splashing out on non-essential items, with incomes not stretching as far as they did previously. The impact of Brexit is becoming more apparent, and as fewer offices are fully staffed five days a week, there is less demand on some high streets.

While it is of benefit to see how we are measuring up to the pre-covid period, now that we are not comparing against lockdowns or strict restrictions, we can once again look back to the prior year for performance comparison purposes. If we keep looking back to 2019 as a measure of retail performance – when do we stop?

Explore related topics