Article

Is remote working really impacting retail footfall?

Following the COVID-19 pandemic, many of us still work from home at least some days of the week, with some employees working fully remotely. However, despite research suggesting that hybrid working makes employees ‘happy, healthier, and more productive,’ more and more companies are mandating returns to the office, with the threat of pay and promotions being linked to workplace attendance. Numerous workers who were hired for fully remote positions, or who moved to different cities from their workplaces during the pandemic, are now being expected to start attending the office more regularly.

There are several reasons why employees are being asked to attend the office on a more regular basis. Some businesses argue that in-person interactions lead to better team collaboration, with others believing that employees are more productive when working in the office.

However, another reason some are keen to see a return to the office is the perceived impact of remote working on retail footfall. With fewer people working in city centres, or only being there on certain days of the week, concerns have been raised that this is negatively impacting retail.

What are the pros of remote working?

One of the key drivers of remote working is the additional flexibility. For some, remote or hybrid working has now become the norm, with more than half of professional Londoners saying they would not accept a job that does not offer such flexibility. In fact, there is such a demand for home working that when Dell told its employees that they wouldn’t be eligible for promotions unless they came into the office for at least three days a week, half still decided to stay at home.

Remote working is especially beneficial to people with disabilities, parents, and other people with caring responsibilities, making it much easier to juggle childcare and do the school run without also having to factor in a long (and sometimes expensive) commute. It has also allowed some workers to cut costs by moving to cheaper areas and get rid of their cars/travel costs, whilst still doing the same job.

There has also been research which suggests that working from home can bring health benefits, with home working meaning employees can have access to healthier food options. Employees also reported an improved work-life balance when working more from home. According to Forbes, 53% of people said there were fewer distractions, and 52% found they were completing their work more quickly.

Another benefit of remote working many have also enjoyed is the ‘workation’ – working remotely in another country. Japan announced earlier in 2024 that it would start issuing ‘digital nomad’ visas, allowing visa holders to live and work remotely anywhere in the country for up to six months. Workations have become a way for people to experience another country without having to use annual leave, something that was pretty much unheard of pre-pandemic.

So why do businesses want people back in the office?

One of the big reasons that many businesses have mandated a return to the office is teamwork and collaboration. When Boots ordered staff back into the office five days a week, in-person meetings, conversations and catch-ups were cited as one of the main reasons behind the decision. THG, who have also asked head office staff to be office based for the entire week, gave similar reasons, saying that ‘face-to-face interaction has a hugely positive impact on our business environment.’ Amazon has also recently mandated a 5 day office week, arguing that it helps staff to be ‘better set up to invent, collaborate, and be connected enough to each other.’ Then, there are other leaders who simply argue that remote employees are unproductive and not doing “proper work”.

Some employers want to keep a closer eye on their staff to make sure they are staying productive. It came to light recently that US bank Wells Fargo made a number of people redundant for ‘mouse jiggling’ – ‘faking’ keyboard usage to make it look as though they were working. PwC also announced that it was to begin monitoring its UK employees’ working locations to ensure they were returning to the office three days a week. This is despite research by the ICO finding that 70% of people surveyed saying they would find workplace monitoring intrusive.

Working from home can also make it difficult to ‘switch off’, with there being a lack of boundaries between a work space and a home space, leaving employees unable to disconnect. There are also concerns that employees are left unsupported with their mental health, with research finding that remote workers can feel isolated and less connected to their colleagues. And whilst some workers have reported an improvement to their work-life balance, others have found they are actually working longer hours. Additionally, there are also concerns that young people who are just entering the workforce are at a disadvantage by working from home. Not only can it be difficult to learn how to do the job when working remotely and without an in-person mentor, it can also mean being overlooked and missing out on promotions.

Finally, the digital nomad movement has faced some criticism, with people working remotely from other countries being accused of distorting local housing markets. Unlike tourism, the influx of digital nomads isn’t creating jobs, with rents increasing to attract people from other countries on higher salaries than local ones.

What about retail?

Of course one of the big questions is the impact of remote working on retail. Retail store staff naturally cannot work from home, but if everyone else is, what does that mean for previously-busy city centres? If office workers aren’t popping out on their lunch breaks to grab a bite to eat or do a spot of shopping, is this spend instead being shifted to local high streets? Or are people just having lunch at home and shopping online instead? Is this contributing to the “death of the high street”? Or is it driving high streets to have to be more innovative, or diverting footfall to more local destinations?

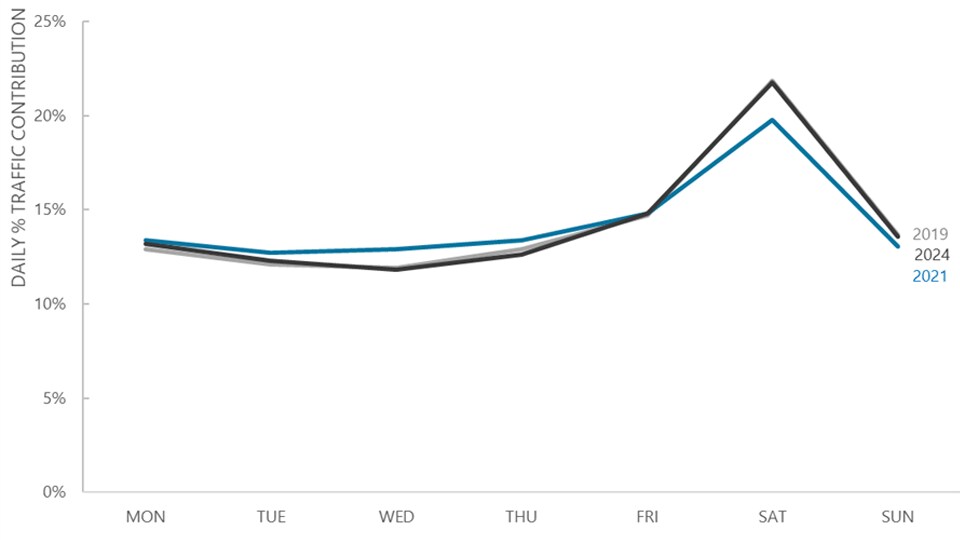

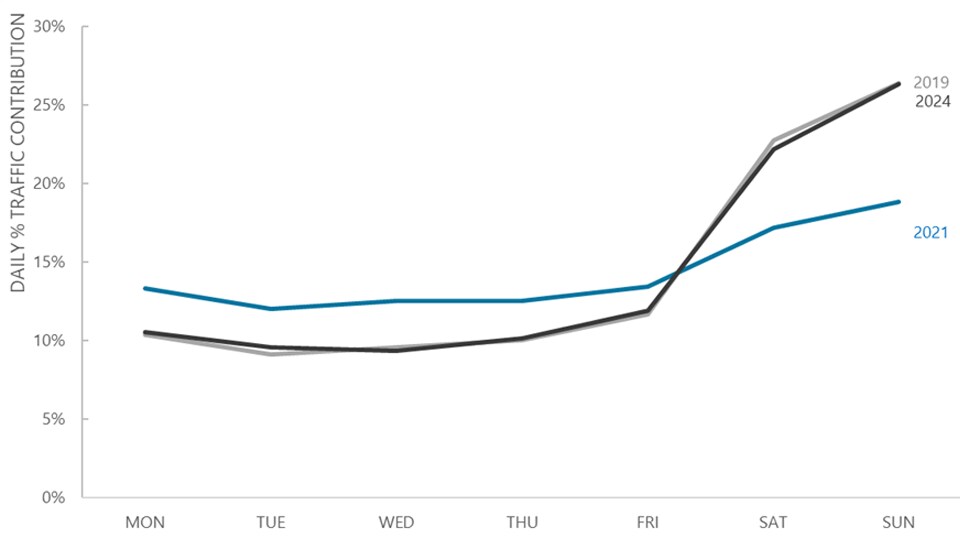

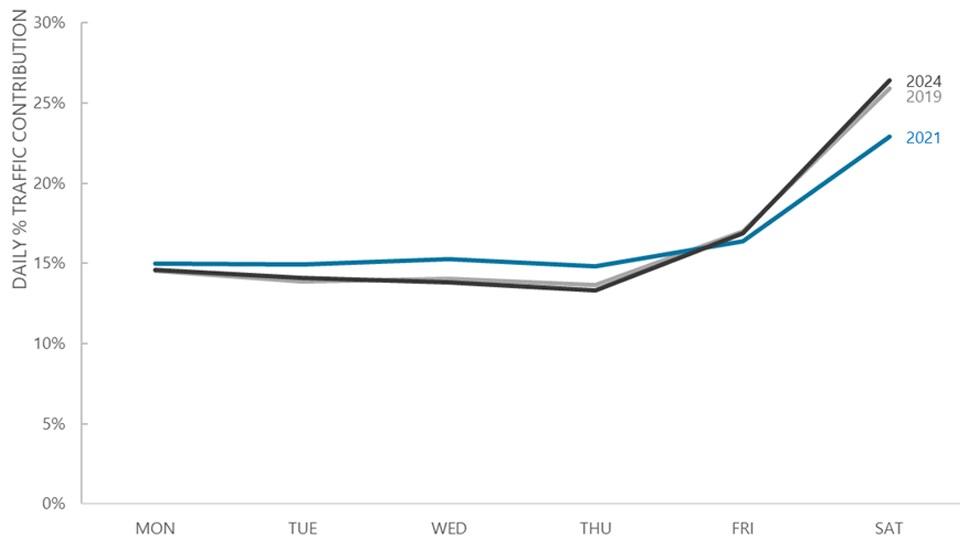

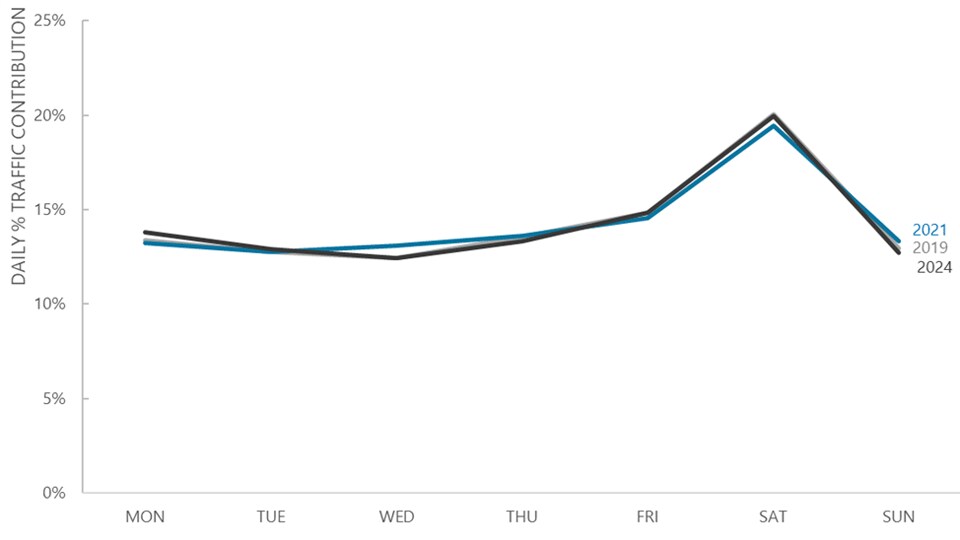

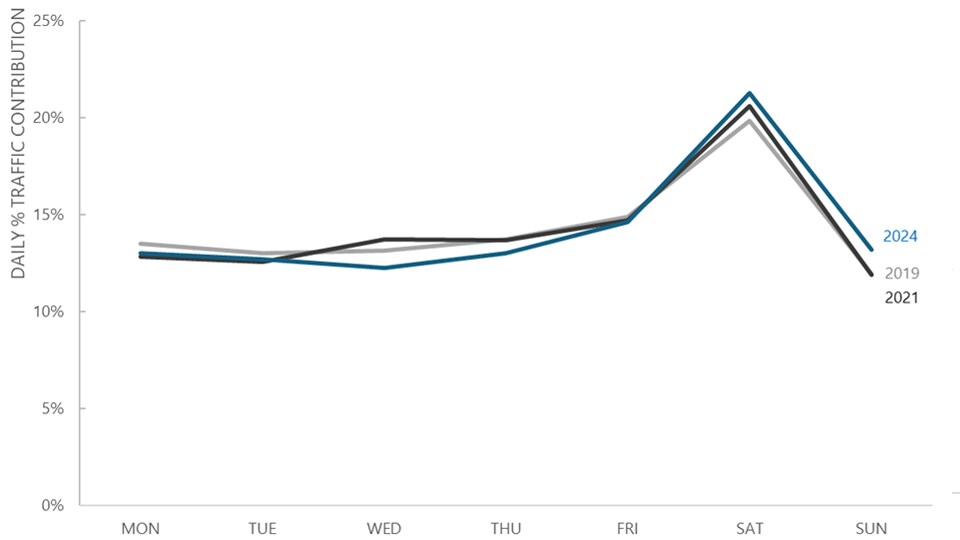

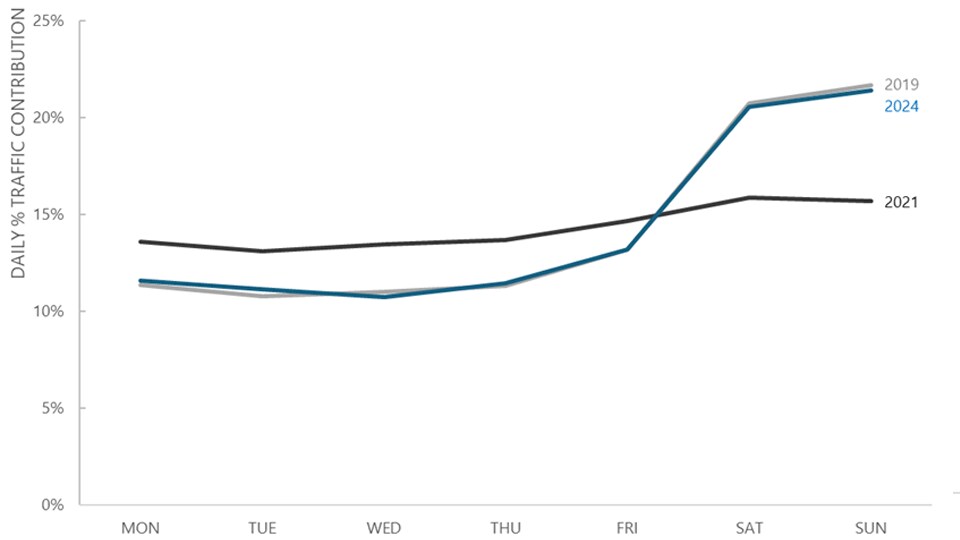

Certainly during the pandemic, we saw a shift in shopping trends. Sensormatic’s traffic data shows that retail traffic was more evenly distributed across the week. Whilst Saturdays remained the busiest shopping day of the week for most of EMEA, the proportion of people shopping on the weekend fell as more people shopped on weekdays.

A few years later though, and we can see that, for the most part, shopping patterns have actually shifted back to pre-pandemic trends, with the weekend once again taking top spot:

Please note that the traffic data used for the following graphs is based on ‘same-site’ traffic, meaning that data has only been used from sites which have remained open from 2019-2024.

Whilst Saturdays in the UK and Sundays in Italy remained as the busiest shopping day during the pandemic, we can see that some of the traffic was being diverted to weekdays – especially in Italy. As we move on a few years to the present day however, we can see a remarkable shift in traffic patterns. In the UK, Sundays now account for more traffic than every weekday apart from Friday, whereas in 2021, Sundays only accounted for more traffic than Tuesdays and Wednesdays. In Italy, both weekend days were always busier, but the proportion of traffic on Sundays is now over 7 percentage points higher than it was in 2021.

A similar story to the UK can be seen in Spain and France. France saw a drop in the proportion of weekend traffic in favour of weekdays during 2021, and has now returned to 2019 trends. In Spain, the proportion of weekend traffic is still slightly lower than 2019, but is higher than 2021.

Germany saw a slightly different change in trends. With Sundays being closed anyway, Saturday was always going to be busy. However, we can now see a steady decline in weekday traffic in 2024 (compared to 2021), as Saturday has picked up again:

Please note retail in Germany is closed on Sundays, so is not included on the graph.

What does this mean for cities? Despite more companies mandating a return to the office and many employees working at least some days in the workplace, remote workers are still being accused of ‘killing the high street,’ especially in busy hubs such as London. Fridays are said to be especially quiet, with many hybrid workers opting to work from home on this day. Is this really the case?

We can see that there has been little change in retail trends in London. Surprisingly, the overall traffic distribution during 2019 was largely similar to that of 2021. Weekends always accounted for the highest levels of traffic, and this has remained unchanged. Fridays are still the busiest weekday, and whilst they account for a slightly lower proportion of traffic than that of 2019, the overall change is minimal.

Other cities have seen slightly different changes in traffic trends. For example, the weekend now accounts for a slightly higher proportion of traffic in Paris, while Wednesdays and Thursdays are lower. However, overall traffic patterns have not changed that significantly.

Looking at Madrid, while there has been some minor changes in traffic trends since the pandemic, it isn’t substantial. Saturdays still account for the largest proportion of traffic, albeit slightly lower than 2019. Instead, Sundays now account for a slightly higher level of weekly traffic.

If we look at Rome however, 2021’s traffic trends were clearly an outlier, with traffic patterns changing drastically during the pandemic. Traffic trends have since returned – almost identically - to pre-pandemic patterns.

So while the pandemic period forced a change in shopping patterns at the time, four years on it looks like trends have – for the most part - reverted back to how they were, albeit with some minor variations. Shopper numbers have not yet returned to pre-pandemic levels, but there has been little change in when people are shopping. The weekend still reigns supreme, with Saturdays and Sundays being when most shoppers are visiting stores, even if it's at a lower level than 2019.

However, with a number of high profile administrations including Homebase, Carpetright, The Body Shop, Esprit, and Sportscheck, there is still the argument to be made that the high street is struggling. However, this looks to be less to do with people working remotely, and instead due to number of other factors.

Talk of the ‘death of the high street’ is not new. Even in 2018 – two years before the pandemic and before people started working from home en masse – there were reports about the high street being in crisis. Many of the reasons given are ones we are seeing now – people having less disposable income, more online shopping, stores not attracting customers the way they once did. Even now, despite people returning to stores, the appetite for online shopping has not abated, with ONS figures showing levels of internet sales are still significantly higher than they were prior to COVID. And now, we have new players in the game, with Chinese shopping apps Temu and Shein promising seemingly endless amounts of fashion and everyday items at ‘mindbogglingly’ low prices. With budgets continuing to being tight, evermore consumers are turning to these cheap shopping apps, despite numerous concerns about data security and US government investigations finding that there is an ‘extremely high risk’ that products sold on Temu could have been made with forced labour.

What's next for retail?

So in a world of remote working and increased reliance on ecommerce, what is driving people into stores now? Increasing numbers of retailers are investing in physical retail with upgraded stores offering new experiences and events. JD Sports opened its ‘biggest store to date’ at Westfield Stratford City in April last year, having given the store a ‘digital uplift’ and extending the retail floor by 4,000sq ft. Sephora returned to the UK in 2023 after a 20 year hiatus, and is continuing to expand across the country. Hamleys has launched a new ‘beauty and dress up boutique’ at its flagship store on Regent Street, whilst Hotel Chocolat has opened its first bakery and hot food offer.

Then there are digitally native brands who are opening their first retail stores. Sosandar has entered the brick and mortar market, with a plan to open around 50 stores in the next 3-5 years. Elemis opened its first UK store in Covent Garden over the summer, whilst Lookfantastic has opened its first physical store in Altrincham.

Retailers are also investing in new store formats to attract customers who previously may not have been able to pay them a visit. Pets at Home, usually located in retail parks, is rolling out small format stores which will sell a ‘range of pet owner essentials,’ and comes without the usual vet and grooming services. Screwfix – usually based on trading estates - is opening up a number of inner city convenience stores called ‘Screwfix City’, which targets customers who may struggle to get to a more traditionally located store. Then we also have retailers who previously haven’t traded in retail parks, such as Hotel Chocolat, now focusing more on these shopping destinations.

Whether working from home, or working in the office, people need a reason to visit physical retail stores. If stores are based in a convenient location, and make the visit worthwhile through interesting store formats, experiences, and great customer service, then customers will be more inclined to visit regardless of their working location.

Explore related topics