Article

The New Rules of Back to School: 2021’s Return to Normal

Will this year’s back-to-school season be back to normal, or can retailers expect another year of reduced revenue due to the pandemic?

In retail, few seasonal events can be counted on to predictably deliver revenue like back-to-school (BTS) shopping. It’s an inevitable annual event that sends parents and students into stores and online to shop for the coming school year. With most schools closed for physical attendance last year, there is much uncertainty going into this year’s BTS season. Retailers, parents, and educators alike are all grappling with questions like:

- Will the increase in vaccinations ensure kids are going back to school, or will the rise of COVID-19 variants shutter schools for yet another year?

- Will a hybrid education model — with students in school for part of the week and at home for others — change their BTS needs?

- Will concern over economic uncertainty make parents hesitant to spend?

While we still don’t know the answers to all these questions, we do have data that sheds light on how many parents plan to approach this BTS season.

After surveying more than 1,100 back-to-school shoppers on their plans, priorities, and expectations for this BTS season, here are three key takeaways retailers can use to make the most of this year’s BTS season.

BTS shopping cycles return to normal

Last year, in the middle of the pandemic, what little BTS shopping did occur happened largely in August. That’s likely because relatively little BTS shopping was needed due to widespread remote learning. But now that vaccinations are up and the pandemic appears somewhat under control in many states, students are going back to classrooms. That means parents are back to buying shoes, apparel, backpacks, and other tried-and-true BTS mainstays — and they’re starting this shopping cycle based upon historical activity, which is sooner than last year.

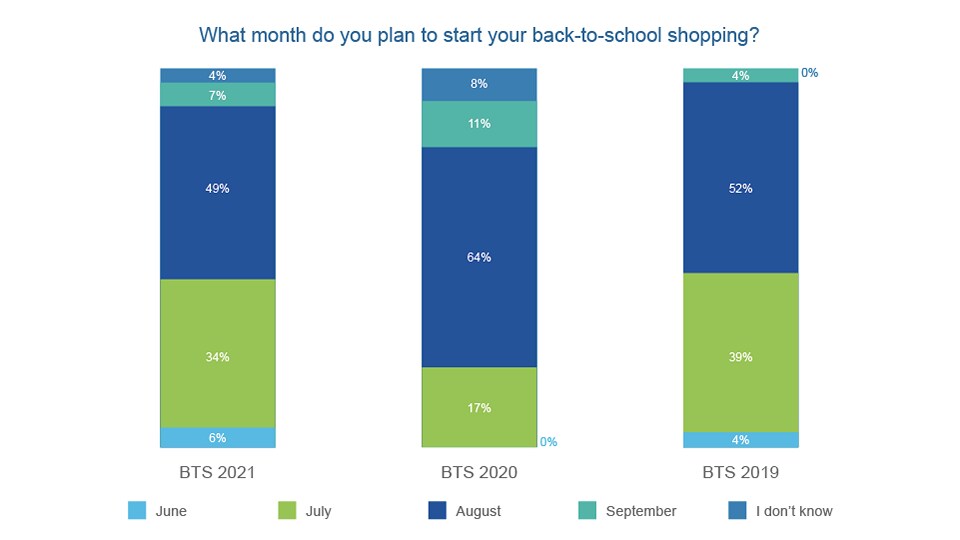

This year, 34% of respondents said they would start shopping in July, up from 17% in 2020 — and much more in line with 2019’s pre-pandemic level of 39%. This year, about half (49%) said they were waiting until August, which again aligns with the 52% who said the same in 2019. In 2020, however, 64% planned to wait to get what little BTS shopping they needed done until then. After all, with no need for new clothes, shoes, backpacks, and the other paraphernalia required for in-school classes, shoppers during 2020’s BTS season could afford to wait until the last minute.

It appears that BTS started early for some shoppers out for deals. Forty percent of BTS shoppers said back-to-school was their primary reason for shopping during Amazon’s Prime Day event, which happened on June 21 and 22.

But when they shop isn’t the only behavior returning to pre-pandemic levels. Where they shop is also coming back to normal. Seventy-six percent said that they plan to do their BTS shopping in-store, and 54% also indicated that they would opt for “buy online, ship to home” shopping. Similar to pandemic trends, one-third plan to use BOPIS (buy online, pick up-in-store), and just 22% plan to use curbside pickup.

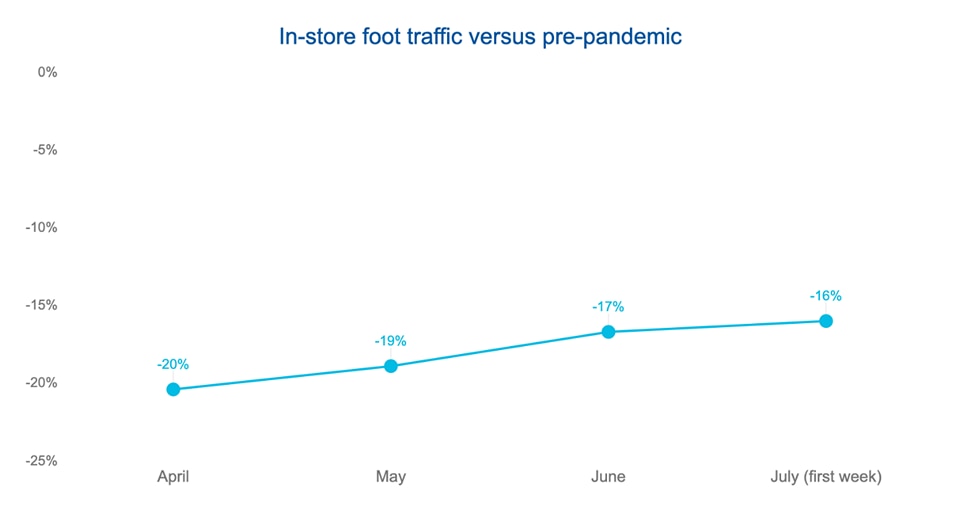

Sensormatic Solutions’ own data also indicates a growing eagerness to shop in-store. While traffic figures are down across the board compared to 2019’s pre-pandemic levels, the gap between pre- and post-pandemic traffic is narrowing as consumers ramp up their BTS shopping.

One thing that hasn’t changed, is consumers’ focus on price and product availability. At 81% and 73% respectively, price and product availability remained the top two factors for back-to-school shoppers. Given Deloitte’s recent findings that 50% of shoppers are concerned about stockouts, successful retailers have already begun to focus on more effectively forecasting demand, ensuring that their stores have the right stock (and staffing levels for service) to capitalize on improving BTS trends.

“After a year of minimal in-store shopping and comparatively little BTS spending altogether, BTS shoppers are once again eager to spend — and eager to spend in stores.”

– Amy Shulman, global head of retail consulting and analytics at Sensormatic Solutions

BTS spending is returning to normal — albeit gradually

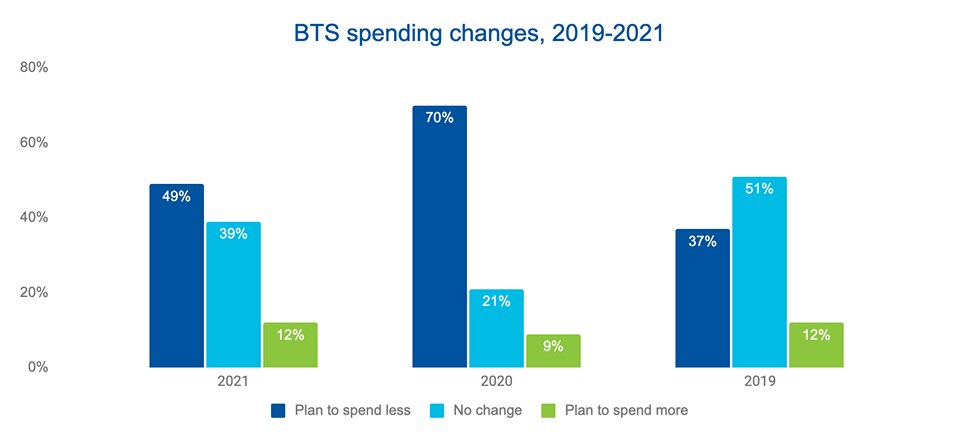

More than half (51%) of shoppers said they plan to spend more or about the same, signaling a return to pre-pandemic levels. In 2020, 70% planned to spend less on BTS shopping — likely because of economic uncertainty or the simple fact that there were far fewer BTS items needed due to remote learning being the norm.

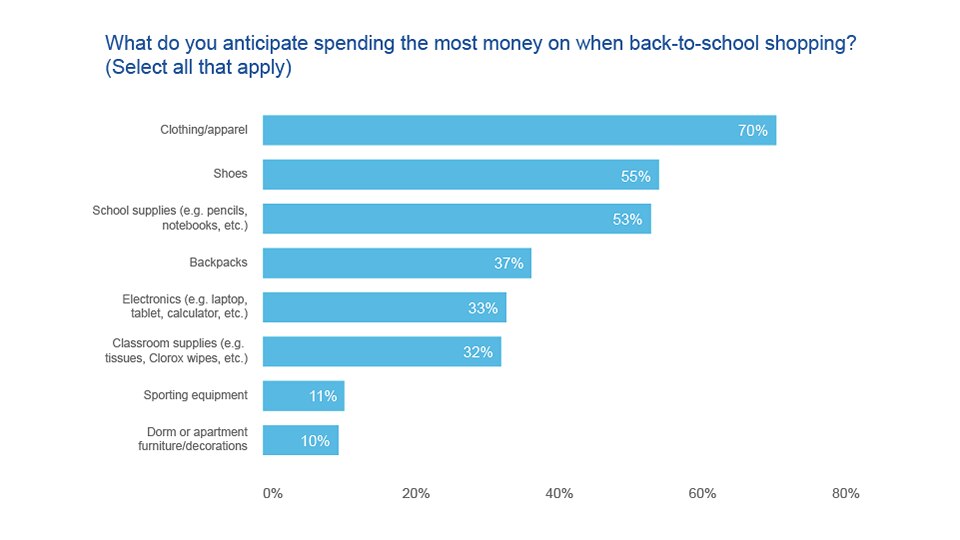

As students think about returning to school, they’re also looking for new clothes and shoes. Among those whose kids are returning to school “fully in-person,” almost four in five (78%) said they planned to spend the most on clothing.

Furthermore, the kind of clothing they’re buying is changing. While athleisure wear captured the bulk of 2020’s BTS spend, 70% said they plan to spend most of their BTS budget on casual clothes, like jeans, graphic tees, and the like, and 55% will be looking for new shoes.

It’s also worth noting that federal child tax credits began landing in parents’ bank accounts starting July 15. Historic foot traffic data suggests these payments will boost BTS spending. Previous Sensormatic Solutions’ data has shown that stimulus checks issued during the pandemic increased in-store foot traffic by 10 to 12 points for up to three weeks each time they were issued — so retailers may see similar gains in late July.

“BTS shoppers this year have largely shaken off their concerns about health and safety, and they want to shop in-store — and when they do, they want it to be quick and convenient.”

– Amy Shulman, global head of retail consulting and analytics at Sensormatic Solutions

Consumers are less concerned about health safety — and more concerned with speed

While the pandemic raged, in-store shoppers had every reason to want safe and comfortable shopping experiences. Today, however, they seem much more at ease with in-person shopping and far less concerned about health risks. As recently as this past winter, almost two-thirds of shoppers (65%) said they had concerns about shopping in-store. Today, almost three-quarters (73%) are either neutral or unconcerned about shopping in-person.

Whether we can attribute this to widespread vaccinations or being increasingly at ease as a result of retailers’ health-and-safety protocols, it’s clear that the fear and uncertainty that came with in-person shopping at the height of the pandemic have waned. And they’ve not only waned — they’ve been replaced with the need for speed.

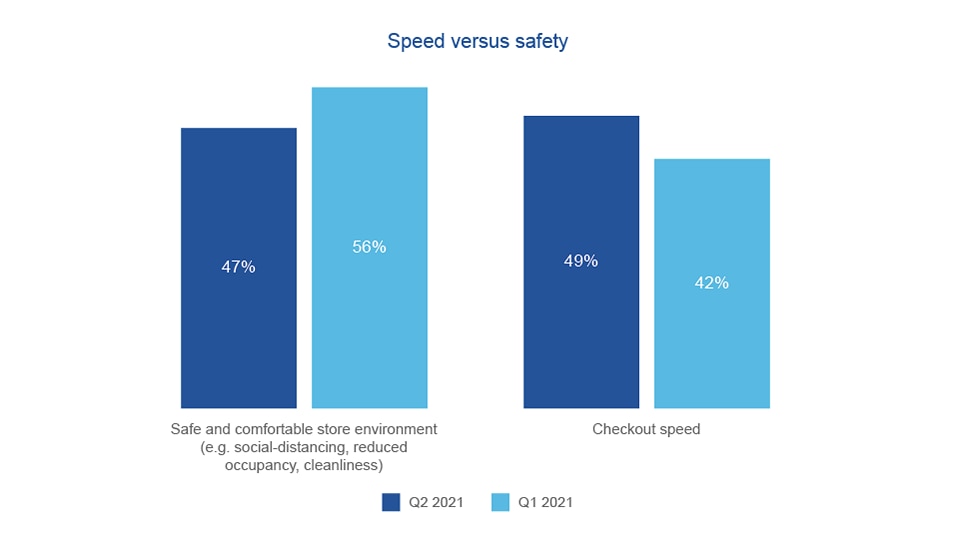

Last spring, 56% said “a safe and comfortable store environment” was most important when shopping in-store. But just a few short months later, that number has dropped to 47%. Compare that to the 49% who now say that checkout speed is most important. While price and product availability topped the list of importance in both surveys, consumers’ reversal on the importance of these two factors is nonetheless noteworthy.

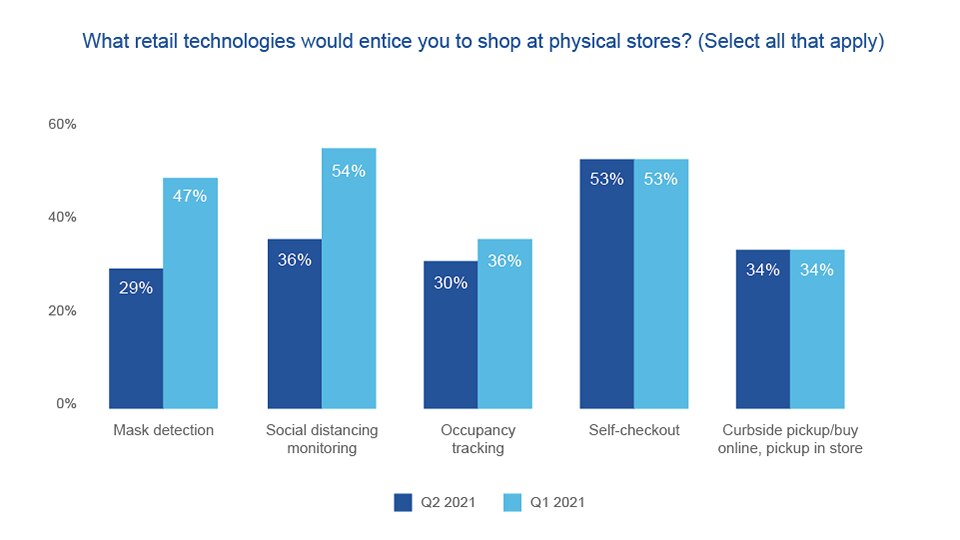

Our survey also found that consumers are far less concerned about health and safety measures than they were earlier this year. Interest in social distancing monitoring, mask detection, and occupancy tracking all fell quarter-over-quarter, but interest in two other factors remained unchanged: self-checkout and BOPIS (buy online, pick up in-store).

All told, BTS shoppers this year have largely shaken off their concerns about health and safety, and they want to shop in-store — and when they do, they want it to be quick and convenient.

“Seventy-six percent of consumers said they planned to do their BTS shopping in-store.”

– Amy Shulman, global head of retail consulting and analytics at Sensormatic Solutions

The takeaway

After a year of minimal in-store shopping and comparatively little BTS spending altogether, BTS shoppers are once again eager to spend — and eager to spend in stores. Their primary spending targets have pivoted from comfy, around-the-house clothing to more traditional school attire, and their concerns over health and safety have been replaced with the desire for convenience, product availability, and speed.

This means retailers need to prepare for a return to normalcy in 2021 — albeit one with a few curveballs. Stores need to be stocked, staffed, and ready by mid-to-late July, and with one-third of customers saying they’ll use BOPIS, retailers will also need next-level inventory tracking solutions in place to ensure satisfactory experiences for every consumer, no matter where their purchases were made.

In sum, BTS shoppers are eager to go back to normal, but not if “normal” means out-of-stock items, disappointing customer experiences, and understaffed and inefficient storefronts. After a lackluster BTS season last year, retailers that can shake off the cobwebs and improve inventory tracking, can deliver exceptional experiences for all consumers. Now is the time to capitalize on a population of parents who are ready to shop.

About the Author

Amy Shulman is the global head of retail consulting and analytics at Sensormatic Solutions. She is a 30+ year outcome-driven senior executive with a longstanding track record of success in driving performance turnaround and revenue growth across industries. Amy has held senior positions, including general manager with P&L ownership, data analytics, marketing, sales, 3rd party alliance development, and customer success roles.

Explore Related Topics