Article

Tradition Meets Technology: What Shoppers Want this Back-to-School Season

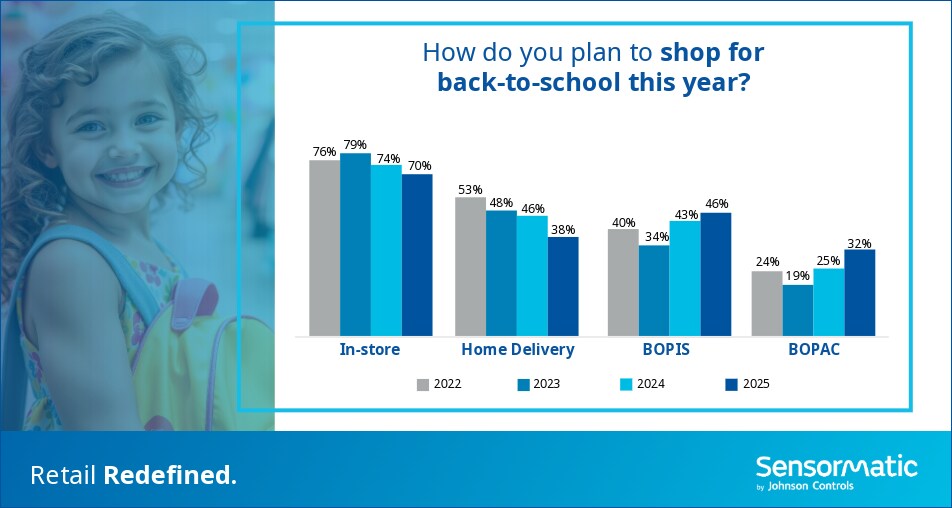

Emerging technology has changed a lot about retail, but it hasn’t changed the importance of Back-to-school shopping for both retailers and families. In fact, the overall shape of the season will look familiar this year, according to Sensormatic Solutions 2025 Back-to-School consumer sentiment survey. Students and parents are eagerly anticipating the start of the back-to-school shopping season, with 70% planning to shop for fresh notebooks, binders, backpacks, and other supplies in-store this year, as they did in 2024.

The preference for in-store visits isn’t the only historical trend continuing this summer…

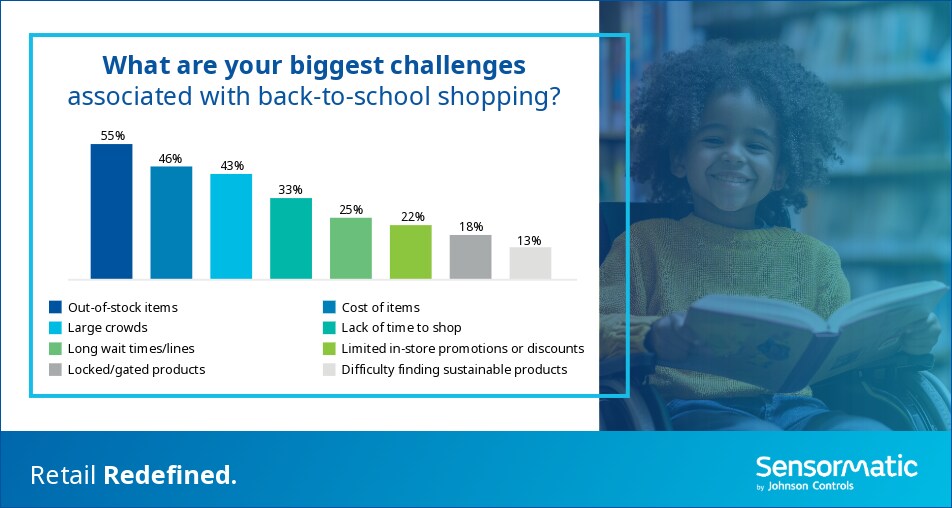

- What shoppers want: Respondents cite price (76%), product availability (65%) and store safety and comfort (44%) as the three most important factors to in-store shoppers, as they did last year. Convenience also continues to be of high importance to shoppers, with lack of time to shop (33%) and long wait times/lines at point of sale (25%) both commonly cited challenges to store experiences among shoppers.

- Where they’ll shop: Free-standing stores and strip centers (40%) remain the most popular option for consumers, followed by open-air shopping centers (26%), enclosed malls (17%) and outlets (14%).

- What they’ll buy: Consumers will spend the most on clothing and apparel (69%), shoes (53%), and school supplies (43%). These have been the top-performing categories in each of the past five years.

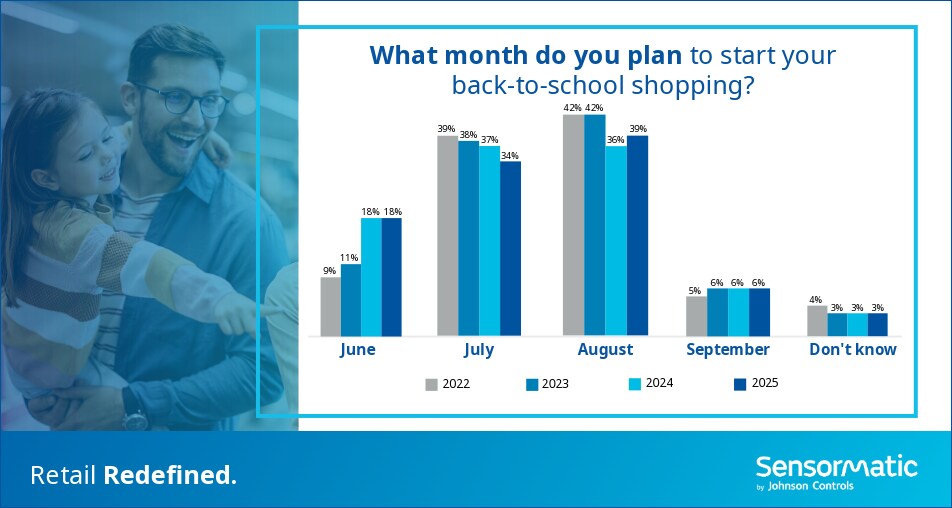

- When they’ll shop: August is the most popular month for respondents to start their back-to-school shopping (39%), with 34% planning to begin shopping in July (which was the top month in 2024). However, a significant portion of shoppers (18%) say they planned to start shopping as early as June—an increase from just 9% in 2022.

However, the survey also reveals notable shifts in the ways shoppers will approach the season—and understanding them is key for retailers as they head into the year’s first real rush.

Direct delivery? No, in-store pickup.

Direct-to-home delivery’s popularity skyrocketed amid COVID lockdowns, with many predicting that brick-and-mortar could never fully recover. Not so.

The proportion of shoppers planning to use ship-to-home options has declined sharply over the past few years, dropping from more than half (53%) in 2022 to just over one-third (38%) in 2025. In that same period, the percentage of shoppers using both “buy online, pickup in store” (BOPIS) and curbside (BOPAC) back-to-school shopping increased significantly.

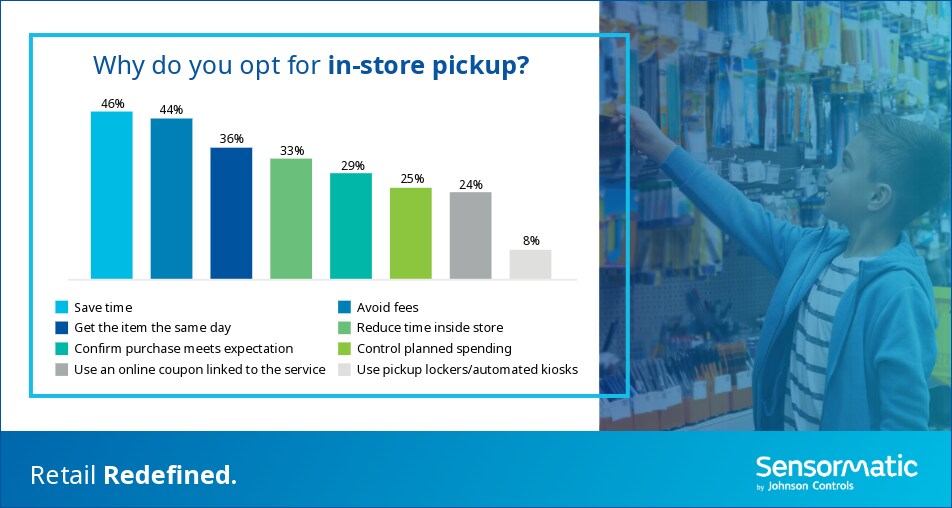

Nearly half (46%) of respondents note that saving time is the biggest motivating factor for using BOPIS options this year, and one-third (36%) say getting a product the same day is a top motivator for their choice. This presents a significant opportunity for retailers, as this additional BOPIS/BOPAC traction means more customers through the doors and more chances to make an impression. Retailers that invest in initiatives that remove friction from omnichannel operations will be better positioned to capitalize on this key customer experience advantage.

Tightening belts are changing decision-making.

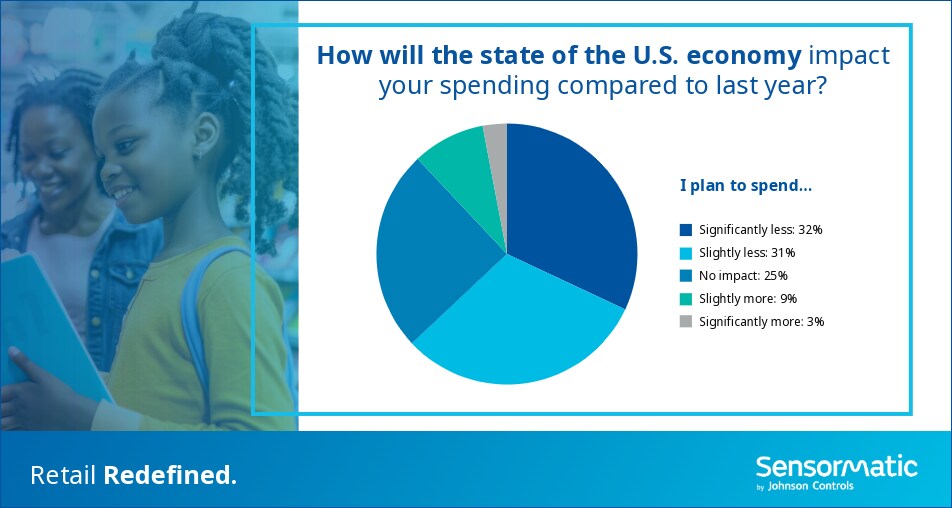

Price sensitivity remains high, with 63% of respondents noting that they plan to spend less on back-to-school shopping than last year.

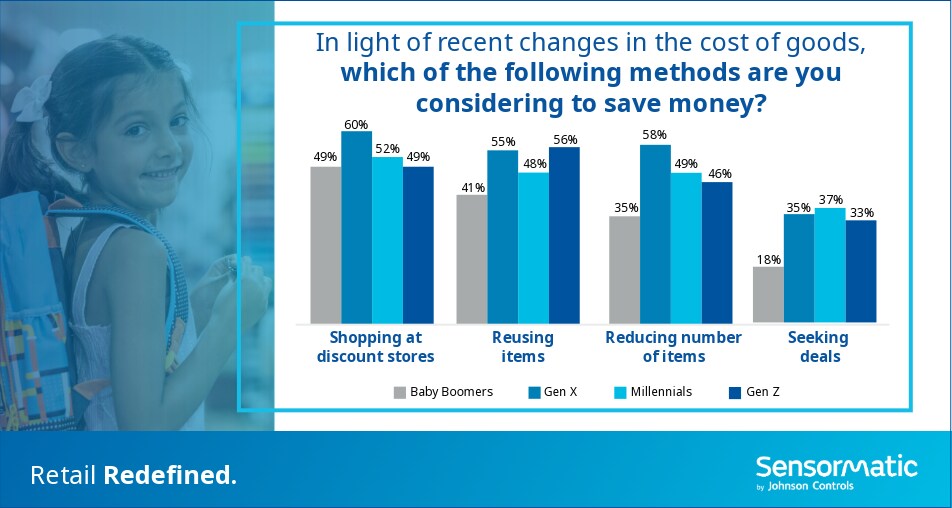

Furthermore, most respondents note that price is the most important factor in purchasing decisions (76%). When facing budget constraints, shopping at discount stores (54%), reusing or repurposing supplies (51%) and reducing the number of items on shopping lists (50%) are the top three ways consumers plan to save this summer.

This may also be a driver of the increased interest in curbside and in-store pickup among shoppers. Almost half (44%) of respondents who plan to use BOPIS say they believe the method will help them avoid additional fees, and one-quarter (25%) will use this method to control planned spending/prioritize specific items when purchasing for back-to-school. Over one-third (34%) of respondents note that they are exclusively seeking in-store or online deals and promotions to cut costs during their shopping trips.

Still, 66% of respondents say that—when in-store shopping during the back-to-school season—they are likely to make impulse purchases; only 32% of respondents rarely (if ever) go off-list when making purchases. With all of this in mind, retailers that develop tailored, personalized promotions tied to in-store visits and pickups may be able to boost sales this summer.

Inventory insights can tip the scales.

Nearly two-thirds (65%) of shoppers said product availability was among their top concerns this year, so it’s no surprise that supply chain anxieties will cause a lot of shoppers perceived challenges. When asked to rank the challenges most likely to impact back-to-school shopping experiences, respondents noted out-of-stock items (55%), the cost of items (46%) and large crowds (43%) most consistently. All three of these concerns, at their core, speak to a lack of confidence in retailers’ ability to keep up with demand in today’s uncertain market.

These worries are also causing shoppers to head to stores at different times. Half (48%) of respondents who say they plan to start shopping earlier say product availability and potential supply chain disruption are among their top motivators. Other popular reasons to start shopping earlier include locking in prices and promotions (44%), shipping delays for online orders (42%) and avoiding stress in the lead-up to school starting (42%).

Brick-and-mortar retailers aren’t immune to supply chain disruptions, but they can get ahead of them to quell shoppers’ worries this summer. Those who invest in source-to-store inventory intelligence systems will be more prepared to fulfill pickup orders accurately, avoid out-of-stocks and help shoppers find what they need to preserve satisfaction.

As families prepare for the new school year, retailers will be under pressure to preserve the elements of in-store experiences that speak to shoppers while adapting to new challenges. It will be an exercise in finding balance between tradition and evolution, shaped by both economic factors and changing consumer preferences. While economic pressures may lead to more cautious spending, the enduring excitement of back-to-school shopping remains evident, encouraging retailers to create compelling and satisfying shopping experiences that resonate with families during this pivotal time of year.

For more back-to-school shopping insights, follow Sensormatic Solutions on LinkedIn and X. For more information about Sensormatic Solutions, visit sensormatic.com.