Article

Did Amazon Prime Day 2020 Impact Brick-and-Mortar Retail?

Ready to see how Sensormatic Solutions can transform your bottom line?

Contact Us

Please select your preferred region

Please select your preferred region

Article

Every year, retail thought leaders promote the idea that Amazon Prime Day and Cyber Monday are making dents in brick-and-mortar. Perhaps one year they will get this right, and considering how disruptive 2020 retail has been, their best hope was for this year. At least as far as the former goes, the story is still “wait until next year,” and here’s why.

Historically, Amazon Prime Day has taken place during the slow retail period between July 4th and the back-to-school season. From an in-store traffic perspective, the days between those seasonal surges are typically the slowest traffic days of the year. Given the already low performance, Amazon’s online only event had zero impact on bricks. You can read more about the summer impact over the years here,here and here .

For 2020, with the pandemic already devastating brick-and-mortar traffic and retail in general, Amazon moved their Prime Day event to October 13 and 14. This made sense on many levels, not the least of which included strategically taking a bite out of early consumers’ holiday shopping lists. This was uniquely important because, as our most recent consumer surveys showed ,nearly 43% of U.S. shoppers polled started their holiday shopping before November – much of it due to social distancing concerns during the bigger holiday shopping events. Couple this with the nearly 39% of consumers preference to do all of their holiday shopping online, and you have a strong opening for Amazon to take some market share away from bricks. As a counter-programming tactic, traditional retailers such as Walmart, Target and Best Buy also kicked off their own big events on the same dates as Amazon. If any of these efforts were to make an impact on brick-and-mortar retail footsteps, we would expect to see a change in the year-over-year traffic trends as compared to other recent days. Two hypothesis made sense:

What did we see for those dates? Not much. To level set, United States year-over-year traffic has been down roughly -27% each week since Labor Day. For those of you not following our weekly ShopperTrak Global Coronavirus Report, this percentage may seem like the death of in-store retail, but it’s actually quite an improvement since the end of Spring, when the U.S. was at -52%. The traffic trends have steadily improved over the summer and into the fall.

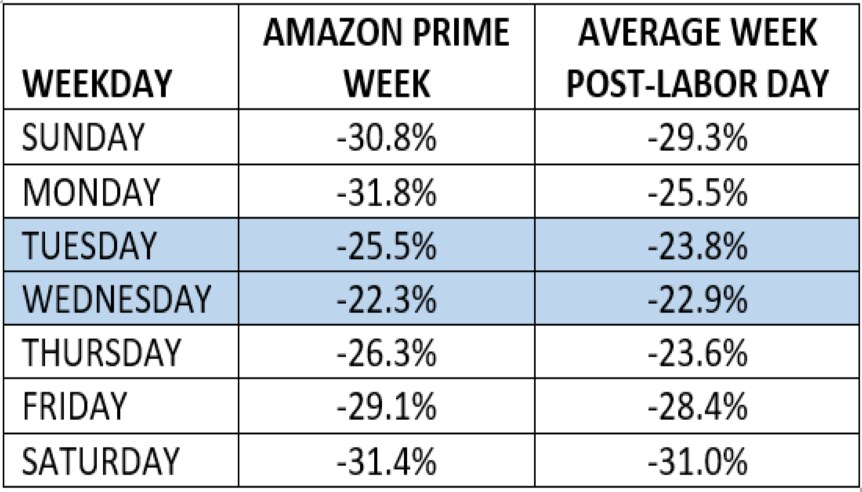

Both Tuesday, October 13 and Wednesday, October 14 outperformed the -27% average, finishing the days at -25.5% and -22.3%, respectively. That sounds like a win for bricks on that day, and just maybe the combination of online and multi-channel retailers offing deals had a positive effect (see #2, above).

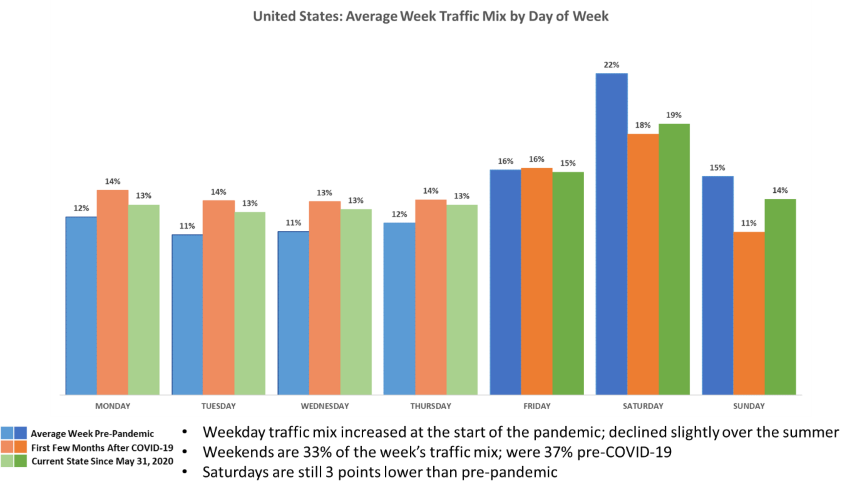

Let’s take a look a little deeper for the true story. Since the outset of COVID-19, American shoppers visit habits have fundamentally changed. In pre-pandemic times, weekends and holiday events ruled. Since mid-March, it has gone the other way, with weekdays gaining traffic mix as compared to weekends. We have been talking about this phenomenon in all of our webinars since May. The fact that Tuesday and Wednesday year-over-year traffic results are outperforming the rest of the week is to be expected these days.

What we need to look at is Tuesday/Wednesday performance since Labor Day in comparison to the Amazon Prime Days. I have laid them out in the table, below:

As you can see, the two days had similar performances to the rest of the post-Labor Day period. Tuesday underperformed while Wednesday outperformed. Aggregated together, the two days experienced a year-over-year -23.9% vs -23.0% for the aggregated post-Labor Day Tuesday/Wednesday. Since they were within 1%, there appears to be no near-term impact from any of the Amazon Prime events. Across the rest of the week, the most significant delta is on the Monday before Prime Day, which underperformed the average by a more meaningful 6%. Could that be an indicator that shoppers were waiting for the Tuesday Prime event? It is more likely that this was the result of Monday, October 12 being its own holiday – Columbus Day/Indigenous Peoples' Day – and the fact that shoppers have been shying away from retail holiday events and perceived bigger crowds.

But there may be implications for the forthcoming holiday season. Assuming that our consumer survey respondents were serious about their early shopping and increasing share of online purchasing, it would be consistent with our seasonal projection of a flattening of the holidays, with smaller peaks for the Top 10 Traffic Days.

We may not be feeling the impact now, but consumers may have already started their shopping engines.